Beginning January 1st, 2025 (subject to legislative approval) the proposed BC Home Flipping Tax period will extend to twenty four months, with some caveats and exemptions which may reduce or eliminate the impact of this tax in certain scenarios.

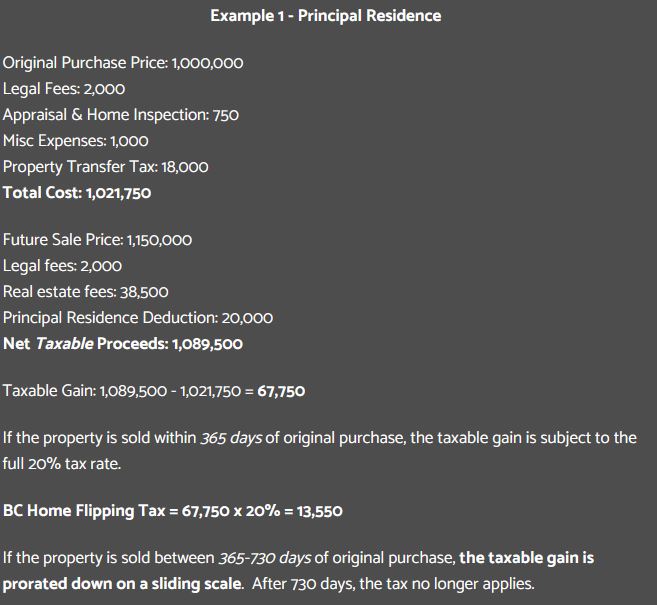

For principal residences, you can apply a $20,000 reduction in the taxable gain in most cases. All of the various expenses realized when purchasing and selling a property can be applied as reductions as well, including legal fees, appraisals, and Property Transfer Tax.

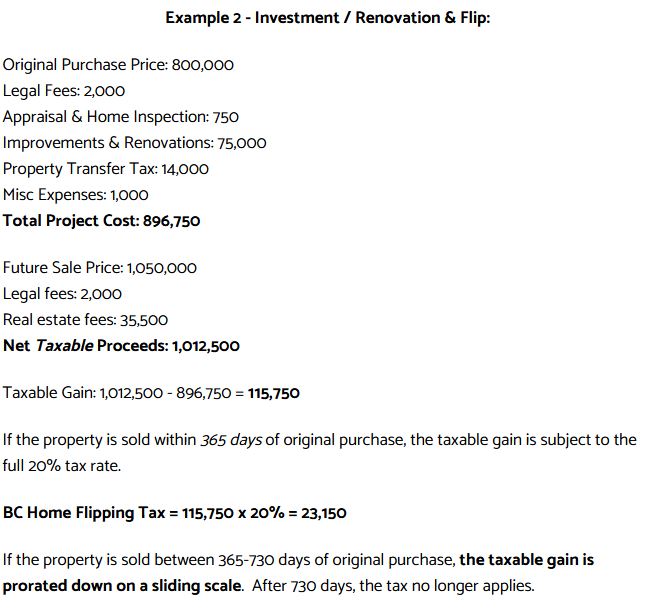

For renovators and true flippers, you will be able to apply the cost of improvements, including appliances and consultations, as expenses. You can also apply the various expenses realized when purchasing and selling the property as deductions.

Below we will illustrate two scenarios for a general idea of what to expect, assuming this rule does become law.

Summary

There are a series of exemptions and deductions that can apply given your specific circumstances, including qualifying relocation, family changes, financial hardship, and so on. See list of exemptions here.

The Province’s new rules do not affect the Federal Government’s flipping rules. Visit the Government of BC’s website for details. For more on how this proposed tax may effect you, give us a call any time.