“How’s the market?”

That depends very much on what you’re selling, or what you’re buying.

There is a wide spectrum of market activity in the Okanagan, largely dependant on price level.

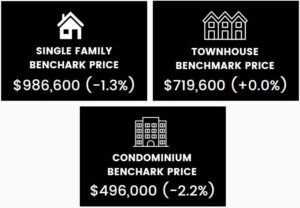

We’ve seen very healthy activity and sales in the conventional single family detached sector. If you’ve got a house in the $1,000,000 ballpark, chances are you’ll achieve a quick sale. If you’re buying in that range, you will likely have to act quickly to make sure you don’t miss a good one.

Same goes for competitively priced townhomes and condos. The luxury segments of these categories are pretty quiet right now, but the typical condo or townhome is moving along smoothly.

Once you move up the price spectrum the story changes a bit, as the $2,500,000+ luxury homes are moving slowly. In fact, there have only been 19 sales of these properties in the last six months, with 4 of those coming in 2024 itself.

If you are selling a home in this range you absolutely must ensure the

marketing and staging are impeccable to position yourself above the crowd.

INTEREST RATES

As you all know, the Bank of Canada has not yet felt comfortable reducing Canada’s prime rate. General sentiment is that we will see reductions beginning in June or July 2024.

However, actual market mortgage rates have come down considerably in the last few months, and in many cases you can now get a fixed rate mortgage for well under 5%. While this is still much higher than previously, it is a big improvement from the 6%+ we saw during 2023.